Thomas Hamlin: Shaping America’s Retirement Conversation Through Trust, Education, and Enduring Leadership

The workforce today is evolving at an unprecedented rate. The new generation workforce, or as fondly called as the Generation Z or GenZ are all poised to redefine the very meaning of retirement planning. For those who don’t already register, GenZ’s are the people born between late 1990s and early 2010s, and these forward-thinking individuals are now entering the workspace, amid uncertainty, rising living costs, and changing career norms. And they are already reimagining how we, as professionals should think about long-term financial security.

Several studies have shown that only about 20% of the Gen Z are currently saving for retirement, which is largely based on the uncertainty surrounding where to begin. Three in four are actively participating in workplace retirement programs such as the 401(k)s or other similar plans and have started saving at a median age of 20.

Unlike prior generations who began saving later in life, many Gen Z workers are engaging with retirement planning at earlier stages — contributing substantial portions of their income once enrolled in employer plans and integrating modern financial tools into their strategies. This shift reflects broader behavioral changes: Gen Z’s priorities span flexible careers, diversified income streams, and technology-driven financial literacy, even as 69% fear outliving their retirement savings and grapple with financial stressors unseen by earlier cohorts.

These trends signal a transition from traditional retirement-ready milestones to a more dynamic, holistic view of financial freedom — one that values both security and adaptability. For industry leaders like Thomas Hamlin, CEO and Founder of Somerset Wealth Strategies, this reorientation presents a strategic imperative: to educate, engage, and empower a generation redefining retirement itself. As Gen Z reshapes expectations, the retirement planning landscape must evolve — and those who lead with insight and integrity will shape the future of financial security in America.

Walking Away to Build Something Better

Most financial leaders build by climbing ladders. Thomas B. Hamlin built by walking away from them.

In the early 1990s, Hamlin entered the annuity business with no formal financial-services pedigree—just a phone, a newsletter list, and a willingness to learn faster than everyone else. Within a year, he became the top producer nationwide at a Los Angeles annuity marketing firm. When he asked for equity, he was turned down. He left.

That pattern would repeat, but each departure sharpened his philosophy. In 1994, after joining Prudential Securities with a mentor, Hamlin discovered a clause that prevented clients from leaving with their advisors. “That was the moment I knew,” he recalls. “If a firm traps clients, it’s not built for them—it’s built for itself.” He walked again, carrying with him a principle that would become non-negotiable: clients must always have freedom of choice.

By 1997, Hamlin launched his own firm under Raymond James, naming it Somerset after the English county where his father was born. Over time, that single firm evolved into the Somerset Family of Companies—Somerset Wealth Strategies, Somerset Wealth Management, and Somerset Securities—each designed to eliminate conflicts, proprietary pressure, and restrictive contracts.

Buying and reengineering a 50-year-old Boston broker-dealer in 2012 gave him what he had always sought: total independence. No non-competes. No captive products. No institutional handcuffs. “If it doesn’t serve the client,” Hamlin says, “it doesn’t belong in the structure.”

The Annuity Contrarian Who Built a Fortress

While much of Wall Street dismissed annuities as outdated or inefficient, Hamlin took a different view. “Most Americans don’t need more risk,” he explains. “They need fewer financial unknowns.” Over 35 years, that belief translated into more than $1 billion placed in annuities for nearly 5,000 clients, with Somerset now producing $100 million annually in annuity business and expanding rapidly in fee-based assets.

In 2000, frustrated by the lack of unbiased consumer education, Hamlin launched AnnuityFYI, one of the industry’s first independent annuity education platforms—followed years later by the Conquering Retirement podcast. Both remain deliberately non-proprietary. “Education loses credibility the moment it’s tied to a quota,” he says.

Today, as interest rates hit multi-decade highs, Hamlin argues the annuity conversation has finally caught up to reality. With lifetime income payouts now 40–70% higher than just a few years ago, he sees a generational opportunity—one rooted in guarantees, downside protection, and income certainty rather than speculation.

Operationally, Somerset mirrors that same contrarian discipline. AI is embedded not for optics, but for execution—onboarding, compliance, analysis—while long-tenured team members and family continuity signal stability in an industry known for churn.

Hamlin’s own metaphor is telling: “We built a Category 6 structure in an industry full of Category 4 firms.” Markets shift. Regulations tighten. Trends change. The structure stands.

After three and a half decades, his core belief remains unchanged: financial freedom shouldn’t feel like Russian roulette—it should feel like sleep.

Built for the Client, Not the Product: The Somerset Philosophy

Somerset did not begin as a multi-entity financial platform. It began as a response to a problem Thomas Hamlin saw early and refused to accept. As a young advisor, he noticed that people nearing retirement were often overwhelmed—confused by complexity, pressured by incentives, and unsure whose interests were truly being served. “Too often,” Hamlin says, “the system worked better for advisors than for the people relying on it.”

In 1997, he founded Somerset Wealth Strategies in the Portland, Oregon area with a clear mandate: clarity over complexity, fairness over friction, and the client’s interest above all else. What started as a single firm gradually evolved into the Somerset family of companies, each created to solve a specific client need without compromise.

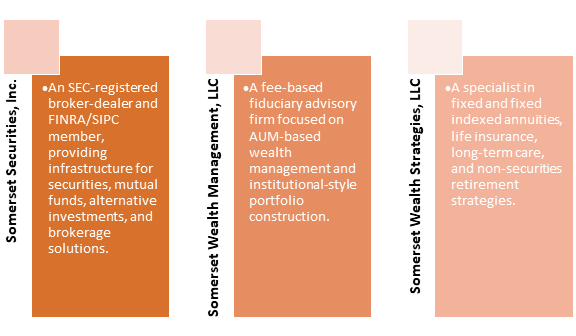

Today, that structure includes Somerset Securities, Inc., an SEC-registered broker-dealer and FINRA/SIPC member originally founded in 1963 and acquired by Hamlin in 2013; Somerset Wealth Management, LLC, a fee-based fiduciary advisory firm focused on disciplined, AUM-based portfolio management; and Somerset Wealth Strategies, LLC, specializing in annuities, insurance, long-term care, and non-securities retirement solutions.

Together, these entities offer a coordinated retirement framework across advisory, brokerage, and insurance—anchored by one leadership philosophy. As Somerset expanded, Hamlin realized education could not remain confined to client meetings alone. That conviction led to AnnuityFYI, a direct-to-consumer platform built on a simple promise: educate first, recommend second, and never place the firm’s interests ahead of the client’s.

AnnuityFYI: Reframing Annuities Through Education, Not Sales

AnnuityFYI was created to solve a persistent problem in retirement planning: complex products explained poorly, often through the lens of incentives rather than understanding. Designed as an independent, consumer-first educational platform, AnnuityFYI exists to demystify annuities and help individuals make informed, confident decisions about long-term income planning.

At its core, the platform focuses on clarity. Financial concepts that are typically buried under jargon are broken down into practical, accessible language—without diluting their importance or nuance. “People don’t need less information,” Thomas Hamlin explains. “They need information they can actually understand and trust.”

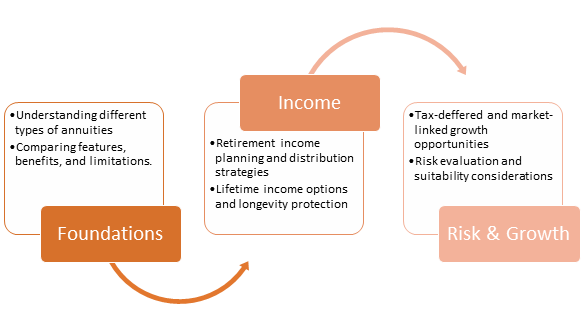

Rather than promoting products, AnnuityFYI organizes education around how annuities function within a broader retirement strategy. Its content framework is built around several key learning pathways that can be visually presented as a decision or discovery flow:

Core Educational Pillars

By guiding users through these interconnected concepts, AnnuityFYI helps retirees and pre-retirees evaluate annuities not as standalone products, but as tools that can support income stability, downside protection, and long-term confidence.

The platform serves a broad audience—consumers, pre-retirees, and even financial professionals—by remaining deliberately neutral, practical, and evidence-based. Its enduring relevance lies in a simple promise: education comes first, recommendations come second, and trust is never compromised.

Somerset: The Architecture Behind Trust and Transparency

Behind AnnuityFYI stands Somerset Wealth Strategies, supported by Somerset Securities, Inc. and Somerset Wealth Management, LLC—a coordinated group of firms designed to address retirement and wealth planning from multiple, clearly defined angles. Together, they form the operational, regulatory, and editorial backbone that allows AnnuityFYI to function with credibility and consistency.

Each entity plays a distinct role that can be visualized as a three-part structural framework:

The Somerset Structure

Somerset’s role extends beyond operations. The firm oversees content governance and editorial integrity for AnnuityFYI, ensuring that all material is factual, compliant, current, and aligned with real-world consumer needs. This includes managing contributors, reviewing research, and maintaining ongoing updates as markets and regulations evolve.

Equally important is tone. Somerset ensures that complexity is translated—not softened—so readers gain understanding without sacrificing accuracy. From content development and compliance review to platform management and organization, Somerset provides the discipline that allows AnnuityFYI to remain trustworthy, relevant, and genuinely educational in an industry where credibility must be earned continuously.

Principles Before Products: The Hamlin Doctrine

Across the Somerset family of companies and AnnuityFYI, Thomas Hamlin operates from a set of principles he considers non-negotiable. “If the philosophy isn’t clear,” he says, “the outcomes never will be.” At the center of that philosophy is education—not as a supporting act, but as the starting point of every client relationship.

Hamlin insists that research, explanation, and context must come before any recommendation. Products are secondary; people are primary. Every strategy is evaluated through the lens of the client’s goals, risk tolerance, tax profile, and family priorities—not commission schedules or internal quotas. “Alignment isn’t optional,” he notes. “It’s the job.”

Equally important is simplification. Somerset takes concepts sophisticated enough for institutional investors and translates them into language that non-experts can understand and act on with confidence. Transparency reinforces that clarity. Costs, risks, limitations, and trade-offs are discussed openly, without relying on fine print to do the heavy lifting.

The ultimate goal is empowerment. Hamlin believes a plan only works if the client understands it well enough to explain it to the people who matter most. These values are not marketing statements; they are embedded in Somerset’s disclosures, training, compliance processes, and daily client conversations. “Trust,” Hamlin says, “is built when people feel informed—not managed.”

Innovation Without Compromise: Technology in Service of Trust

For Thomas Hamlin, innovation is only valuable if it strengthens trust. “Technology should make us more accountable, not more distant,” he explains. Under his leadership, Somerset has integrated AI and advanced analytics into onboarding, data analysis, communication, and operational workflows—always with human judgment, compliance oversight, and fiduciary responsibility at the center.

The objective is precision, not novelty. AI is used to enhance responsiveness, consistency, and scalability while preserving the human relationship that defines meaningful financial advice. “Tools don’t replace trust,” Hamlin says. “They either reinforce it—or they erode it.”

This discipline reflects how Hamlin thinks about risk more broadly. Having navigated every major market disruption since the late 1980s, he designs both strategy and infrastructure with resilience in mind. He often describes Somerset as a “Category 6 structure in a Category 4 world”—built not for ideal conditions, but for stress, volatility, and uncertainty.

Before adopting any system or strategy, he asks a simple question: Will this still serve clients when conditions are not friendly? That lens has shaped everything from compliance architecture to portfolio construction and internal controls. Innovation, at Somerset, is not about speed alone—it is about durability, reliability, and readiness for the unexpected.

Beyond Capital: Building Confidence That Endures

Thomas B. Hamlin’s career can be measured in assets placed, years in the industry, and media recognition. But those metrics, he says, only tell part of the story. “The real measure is whether people feel confident about their future,” Hamlin reflects, “or whether they’re just hoping things work out.”

Over decades, that focus has translated into thousands of individuals and families who understand their retirement strategies rather than merely trusting them. It has produced AnnuityFYI, a national education platform that transformed opaque financial products into understandable tools. It has also shaped the Somerset ecosystem—Somerset Wealth Strategies, Somerset Wealth Management, Somerset Securities, and AnnuityFYI—designed from inception to align expertise, incentives, and execution around the client’s best interests.

Equally telling is the team behind the platform. With more than a century of combined experience and unusually long tenures in an industry known for churn, Somerset’s continuity reflects shared values and long-term commitment.

In a sector often driven by short-term metrics, Hamlin has built something quieter—and more enduring: a high-integrity, high-competence environment where clarity replaces confusion and confidence replaces fear. The result is not just better planning, but something rarer—the assurance that retirement is understood, intentional, and never faced alone.

Education Without Agenda

In a landscape where many annuity websites are designed primarily to convert interest into transactions, AnnuityFYI and the Somerset companies have chosen a different starting point: education before sales. “If people don’t understand their options,” Thomas Hamlin says, “they can’t make good decisions—no matter how attractive a product sounds.”

The platform, supported by its companion podcast, is designed to help individuals move at their own pace, free from pressure or persuasion. Instead of funneling users toward predetermined outcomes, AnnuityFYI focuses on helping them understand how annuities work, where they fit within a broader retirement strategy, and whether they are appropriate in the first place. Content is written to serve a wide spectrum of financial experience—from first-time researchers to seasoned investors—by breaking down complex ideas into clear, accessible language without stripping away important nuance.

Navigation, structure, and tone are intentionally practical. Users can quickly find relevant information whether they are exploring income options, researching long-term solutions, or comparing different annuity structures. The emphasis is on decision support, not decision steering. Clarity takes precedence over persuasion, and self-evaluation is encouraged by guiding readers to reflect on their goals, lifestyle needs, and risk tolerance.

That educational commitment is reinforced by rigorous content oversight. Every article and resource undergoes research, editorial review, and compliance evaluation to ensure it meets regulatory standards, reflects current market conditions, and adheres to sound financial principles. Outdated material is revised or expanded, and emerging developments—whether regulatory shifts or product innovations—are addressed promptly through updated content and timely podcast discussions.

For Hamlin, this discipline is essential. “Trust doesn’t come from volume or visibility,” he says. “It comes from accuracy, relevance, and respect for the reader.” The result is an environment where questions are welcomed, knowledge drives action, and confidence is built on understanding—not pressure.

A Future Built on Understanding, Not Anxiety

“When I think about the future of Somerset, AnnuityFYI, and Conquering Retirement with AnnuityFYI, I don’t think first about scale or expansion. I think about how people feel when they’re trying to make decisions about retirement. Too many people still approach that phase of life feeling confused, pressured, or unsure whom to trust. Our long-term vision is to change that experience entirely.

What we are building is a dependable, easy-to-use ecosystem where people can learn at their own pace—without sales pressure, without hidden agendas, and without needing a financial background to understand what they’re reading or hearing. Education will continue to be the foundation. That means expanding our resources across formats—web, audio, and new platforms—so people can engage in the way that suits them best.

At the same time, we are committed to continually raising the bar on quality and clarity. Financial products and regulations evolve, and our responsibility is to stay ahead of those changes while making complex topics easier to understand and easier to compare. If someone walks away with fewer questions and more confidence than they had before, we’ve done our job.

Beyond articles, tools, or podcast episodes, the larger goal is confidence. I want independent learning to feel like a natural part of responsible retirement planning—not something people are intimidated by or avoid. When individuals understand their options, they make better decisions, and they sleep better at night.

Everything we do is guided by that outcome. If Somerset and AnnuityFYI can help more people move toward retirement with clarity, security, and peace of mind, then we are building something that will matter—long after trends, products, and market cycles change.”